Business Insurance in and around Asheville

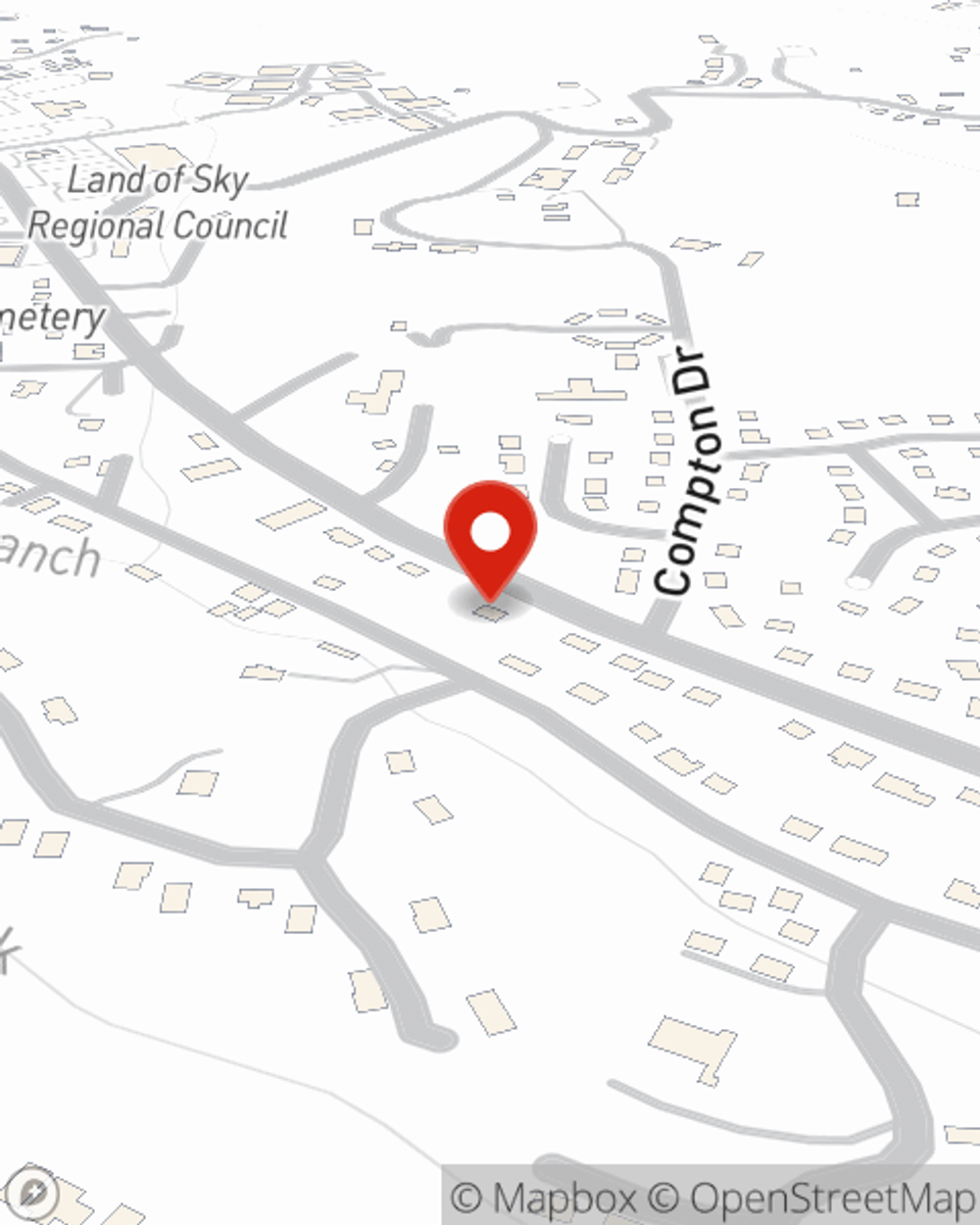

Looking for coverage for your business? Search no further than State Farm agent Wayne Smith!

Cover all the bases for your small business

Help Protect Your Business With State Farm.

When experiencing the wins and losses of small business ownership, let State Farm do what they do well and help provide quality insurance for your business. Your policy can include options such as business continuity plans, a surety or fidelity bond, and worker's compensation for your employees.

Looking for coverage for your business? Search no further than State Farm agent Wayne Smith!

Cover all the bases for your small business

Keep Your Business Secure

When you've put so much personal interest in a small business like yours, whether it's a lawn care service, a clock shop, or a toy store, having the right coverage for you is important. As a business owner, as well, State Farm agent Wayne Smith understands and is happy to offer exceptional service to fit the needs of you and your business.

Call Wayne Smith today, and let's get down to business.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Wayne Smith

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.